The T8 Exemption was created to allow small businesses to get a foothold in the market. It was never planned to be a platform for business to evade environmental permitting

The idea of an Exemption from Permitting is sound, if it allows small businesses to access material and markets and become established, either as a small craft business, or as a collector or processor looking to supply a third party with materials. It also allowed some larger operators to have separate storage and baling plants, for example, without that site needing full permitting. It should have been a positive element of the UK tyre recycling sector.

However, the T8 Exemption has been misused and abused to the point that it has undermined legitimate, permitted businesses – From permitted collectors to processors alike, the impact of the fly-by-night T8 operator has resulted in a near meltdown in UK tyre recycling, something that Tyre and Rubber Recycling has written about several times this year alone.

The problem

A T8 allows up to 60 tonnes of truck, or 40 tonnes of any other tyre type to be handled in any 7 day period to be stored or treated.

The T8 can be accessed by making a telephone call, reportedly an operator can make an application in 15 – 20 minutes. There is no fee charged for the T8 application, and that in turn means that due to the way finances in the EA work, there is no funding to monitor T8 Exemptions. In fact, whilst The EA can say how many T8 Exemptions exist, they cannot say how many of them are related to tyre recovery and recycling, as many Farmers also use T8 to cover the tyres they store for silage clamps.

With no inspection, the only time the Environment Agency becomes involved in a T8 Exempt location is if someone makes a complaint, or, if there is a fire incident. If it becomes evident that the T8 had been abused, the Environment Agency can and will take action.

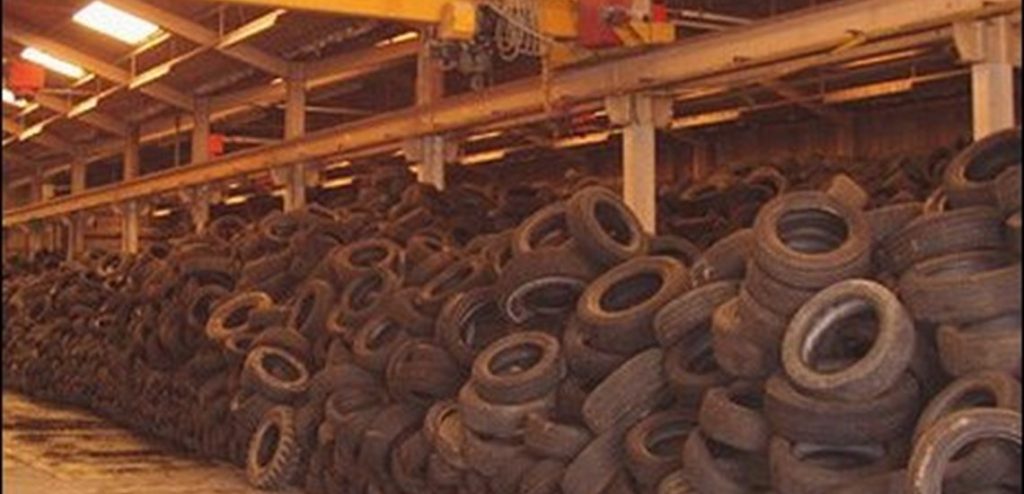

However, there are many operators of T8 sites who are anecdotally shipping four or five containers a week, which means they are exceeding the parameters of the T8. In some cases, these operators can acquire large volumes of tyres that get stored in breach of the T8 conditions.

The basic problem for the UK recycling sector is that all these operators need is a tyre baler, which can be bought second-hand, and they can fill containers as fast as they can get tyres baled. These containers get bought by brokers and dealers – who may hold no licences themselves – and they are shipped out to India, Pakistan, Turkey, and other destinations without due consideration to the end use and whether it will comply with The Basel Convention, which has clear guidance on what is permitted recovery or recycling. The UK is a signatory to the Basel Convention. The fact that the UK allows this abuse of T8 with a lack of control of the final destination, means that the UK is lacking in its Duty of Care.

It also means that operators who make a minimal investment can ship tyres in a manner that undermines any Permitted operation. This drives even Permitted operators to join the race to the bottom shipping tyres out of the country in return for cash in the bank. As a result, the UK, according to the Tyre Recovery Association, has a spare capacity to shred 150,000 tonnes of tyres – and that is without any of the big pyrolysis operations taking a single tyre.

Why is this a problem?

The knock-on effect of the high volumes of Export – figures vary, but could be as high as 350,000 tonnes, which means that there is a shortage of feedstock for even tyre-derived fuel contracts. But it is more complex.

Given the costs of running shredding equipment in the middle of the energy crisis, operators are asking, “Why should I turn my machines on?” So, even if they CAN get the feedstock, the costs are undermined by the ease of exporting at low costs.

Need powderised rubber for an and market? Then the cost differential between exporting and producing powder becomes unsurmountable – there is very little advantage in processing – so almost every player joins the race to the bottom and exports.

So, the industry needs the T8 to go, and it needs better control of exports if it is to be able to survive. The Environment Agency also need the T8 to go, because they know that the T8 is the source of so many issues with tyres. The Scottish Environment Protection Agency found that every single case of waste tyre crime came back to a T8 site, which was why the Scottish Government acted so quickly in ending the T8.

So, what is happening now?

The Environment Agency does not make the law. It cannot change it. It does enforce it. It can make allowances, but it cannot go beyond what the law says. Until now, the strategy has been to encourage by gentle persuasion, for operators to play by the book and up their game. It has not worked. Change is required.

And that change is coming. Defra, which is the Government department responsible for waste, amongst a whole raft of other challenges, has finally come around to understand that there is a real problem with T8 Exemptions. Largely thanks to the work behind the scenes of the Tyre Recovery Association and Peter Taylor and the evidence presented by the Environment Agency. The outcome is that T8 Exemptions are going to be stopped.

Addressing the Tyre Recovery Association’s Briefing Day in September, Howard Leberman, the EA’s senior advisor leading on waste tyres, announced that after an extended gestation period going back to 2016, Defra has announced that the T8 would be no more.

Leberman told the TRA that the government had published the response to the consultation of Waste Regulation Reform. Among the changes will be the prohibition of waste exemptions on permitted sites and the withdrawal of the T8 amongst other changes. The question is now, when will this happen?

Leberman was clear, whilst there was an expectation of the law being changed in the Spring of 2024, it depended upon parliamentary time being available. If it were delayed the legislation could run into the General Election purdah where very little gets done. However, Leberman assured the TRA that both government and opposition parties were in agreement that this would happen, though a change of government could see the legislation called in for review. However, he said, “T8 is going – So, up the game or get out.”

In the meantime, the EA will be consulting on a charging scheme late Autmn for waste exemptions. This will include the T8 whilst it still exists. Fees generated will allow the EA to recruit additional officers to proactively inspect exempted activities.

Many T8 operators would need to make significant improvements to gain a Permit, and some perhaps would be unable to obtain a Permit due to their location and required infrastructure changes.

The Environment Agency anticipate a spike in illegal activity as rogue operators take in as many tyres as they can and then walk away from tyre stocks, but the EA are focussed on this and will come down harder on those breaking the rules.

A standard rules permit is available for operators but any operator looking for something at variance from the norm or operating near to houses or other sensitive receptors will have to make a bespoke application.

Leberman emphasised that the Duty of Care remained, and everyone was expected to play their part in the supply chain to make sure tyres are handled correctly. Changes to the Carriers, Brokers and Dealers may mean that those that deal, or transport waste will need permits to do so. Government has yet to publish their consultation response document setting out what the actual changes will be. Digital waste tracking is also coming down the line allowing the EA to focus their resource on where waste is lost from the system. The TRA are actively involved in what this will look like. The detail is still to be confirmed, and the EA awaits the regulations on this from the government.

Leberman gave his own view that exports needed to be part of the balance but that he would like to see a higher value market by limiting exports to shred in the future. However, that would need a change in direction or a change in the Law.