It sounds like the headline from a tabloid newspaper, but it is not, though it probably should be if the press were remotely interested in the realities of recycling in the UK

India has long been known to have a huge capacity for the UK’s end-of-life tyres. Tyre and Rubber Recycling has been told that the shippers are paying around £1500 per containerload in early February. So, collectors might bring in 100 tyres at 80p a tyre, so £80 per ton collected, then 26 bales of around 800kg in a container (roughly 21 tons) – and the shipper pays around £1500. Add the £1500 to the collection fee of £1680, and each container being shipped has a value to the collector/ baler of around £3,180. For a minimal investment in a baler and a truck. Obviously, the higher the collection fee, the higher the overall benefit to the collector/ baler.

The recycler, who wants to provide the simplest of tyre-derived material, tyre-derived fuel, has, possibly, the same collection fee, but before he can shred, he has to invest in equipment that works – and that comes with a price tag. It also comes with an energy bill that many struggle to meet in the current climate. More than one processor has told Tyre and Rubber Recycling that he cannot get feedstock to fulfil contracts, and even if he could, he would struggle to pay the running cost of his shredding equipment.

The biggest issue for recyclers, though, is the need for feedstock. So why, when the UK produces somewhere around 550,000 tons of used tyres each year, is there a shortage of material for recyclers in the UK?

It is simple – the lack of control at the bottom end of the chain means that a man with a van can collect and dump at an Exempt site with a baler, the tyres get baled, and they get shipped out of the country.

Is exporting tyres a crime? Not at all, but the volume they are being exported in is undermining legitimate tyre recycling operations.

More than one large-scale recycling project has fallen foul of the lack of feedstock. Who is going to invest in a 50,000-ton plant when there are not enough tyres available to keep it in business? This is why Wastefront went to Gateway to arrange a tyre feedstock supply for its proposed Sunderland plant.

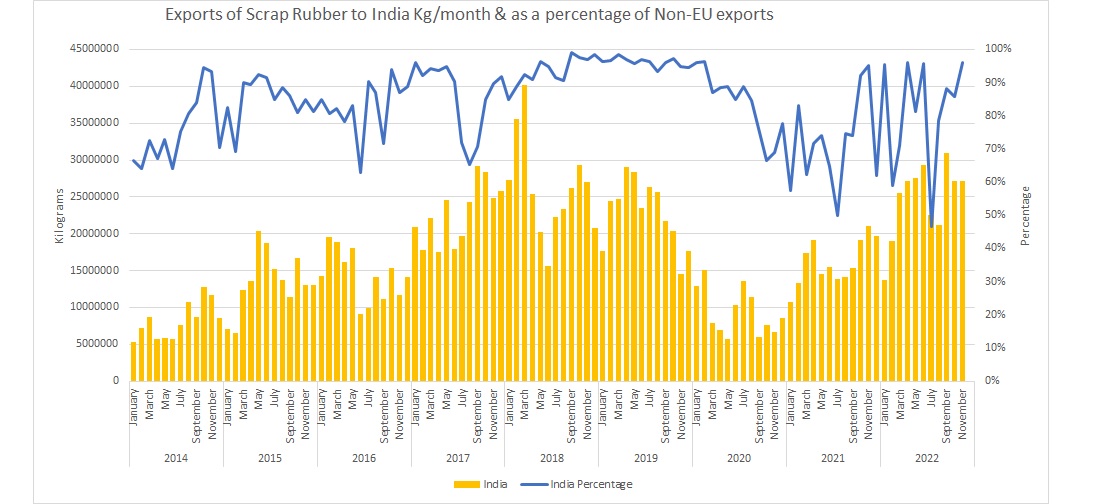

So, let’s look at the export figures

Tyre and Rubber Recycling has an irregular conversation with Peter Taylor at the Tyre Recovery Association, which does a great job in helping manage tyre recovery in the UK. There are precious few large-scale tyre dumps in the UK, thanks to the efforts of the TRA and the EA.

The estimated tyre arisings for the UK stand around 550,000 tons per annum, give or take a few thousand, and the market is relatively stable. So, there is our base figure.

For the last available three months, the EA figures show an average of 31,617 tons of tyres a month being exported from the UK to non-EU markets – that extrapolated over 12 months gives an approximate non-EU export figure of around 379,404 tons per annum.

Additional Information added 8/2/23

UK Trade Info shows 270,096 tons exported to India from 1/1/22 to 30/11/22 being at 271,150 tons. Shangai based Tendata shows imports from the UK at 270,096 to India over the same period (a 0.4% variation).

That estimated figure based on 3 months average, is roughly 69 per cent of UK tyre arisings being exported to India, leaving 170,596 tons being recycled in the UK. One cement kiln could take around 50,000 tons per annum; with six cement kilns in the UK capable of consuming tyres, there is, potentially, a feedstock of roughly 28,000 tons per kiln from that balance remaining in the UK – and that discounts the use of tyres for any other projects at all.

We do not have accurate figures for the cement kilns, but it is clear that these outlets are a huge consumer of tyres; across Europe, the demand for energy recovery is around 45-48 per cent of arisings going to cement kilns, furnaces, and some heat generation.

In the UK, the ease of exports has become an albatross that is killing the UK tyre recycling industry. Of course, there will be some sectors where a large operation, such as the Itochu-owned ETEL, controls part of the supply chain through to the retailer, plus the recovery chain through Kwik Fit (and others) back to Murfitts where the storm may be weathered. Still, the UK needs more than one major recycler. It must allow its recycling sector to become independent of exports and one large operation.

The government needs to act on waste recycling, not just tyres. Steps must be taken to prevent our waste from going to foreign markets where we have no control over how or even if it gets recycled.

However, all quoted figures are less reliable than we might hope. The one agency that should have an accurate record of what gets exported is HMRC. The Code for used tyres is 40 12 20. The figures for the last available year show only 26,000 tons being exported. A contact at the HMRC admitted that there was probably some misrepresentation in Customs Declarations. The figures from the EA show no tyres going to Sub-Saharan Africa, but we know of people using tyre tripling machines to do just that – ship tyres to West Africa.