Tyre Stewardship Australia has been operating for 10 years, and its annual report covers some of its successes in a comprehensive annual report

The full annual report can be found here.

It is worth noting that, as of today, TSA is not a mandatory Extended Producer Responsibility scheme. It is a voluntary stewardship scheme that has aimed to organically grow by bringing importers of tyres, in all their forms, into the association.

Some observers would imagine that this creates loopholes for the less scrupulous to evade managing their waste tyres, and, to a point that is true. However, those evading the system are reducing in numbers as time passes. TSA is becoming increasingly effective at managing end of life tyres and addresses the challenges it has by highlighting them and driving towards more inclusion – at this stage, without mandatory registration.

Rather than going through the report point by point, Tyre and Rubber Recycling has taken a look at some of the achievements and asks why is there such a differential between Australia and the UK?

Australia is a continent with huge logistics challenges, the UK is a group of small islands with a compact, if busy, logistics network. Australia’s population is 26.7 million, the UK’s is 66.97 million. Naturally, the UK vehicle parc is much larger than that of Australia and as such generates considerably greater volumes of waste tyres. Like Australia, the UK has a voluntary tyre “stewardship” scheme in the Tyre Recovery Association. However, there appears to be a huge differential in the way tyres are handled between the two countries.

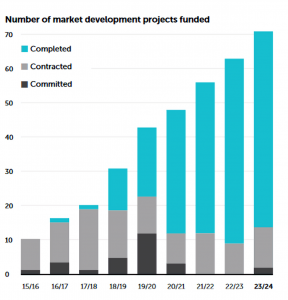

In ten years, TSA has committed $10 AUS in funding to 72 projects. It has put $5.6mAUS into 32 road projects, $1.6m AUS into 14 research projects, $1.6m AUS into 11 civil engineering projects, £1.3m AUS into 10 manufacturing and mining projects and $0.7m AUS into five railway projects.

In the past 10 years the UK tyre recovery sector has generally only seen self-funded projects by a few operators with occasional government grants, but none comparable to those issued by the Australian governments, with no financial support from the Tyre Recovery Association.

Recycling fees in the UK are split between a profit centre for some retailers, and the collection system. There is virtually no governmental support for tyre recycling.

Australia, on the other hand has seen considerable governmental support. Firstly, by the ban on the export of whole tyres. Something that the UK could enact overnight, but persistently refuses to do. Australia’s ban on the export of whole tyres has seen investment in shredding capacity. Even Indian companies are investing in Australia to ensure the continued supply of feedstock for their domestic operations. The ban on the export of whole tyres has transformed the Australian tyre recycling sector.

However, the government did not just put a ban in place. It recognised that the tyre recycling sector needed support, and it has at national and state level provided funding to ensure that Australian recyclers have the capacity to deal with domestic tyre arisings (although, in some places this remains a challenge – In particular the Northern Territory and in mining areas of New South Wales).

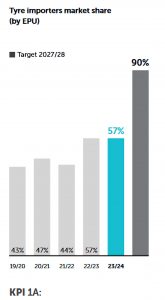

However, as mentioned previously, TSA is a voluntary scheme and after 10 years, participation by tyre importers stands at 57 per cent of the market share. TSA has given itself 3 -4 years to reach a 90 per cent market share participation.

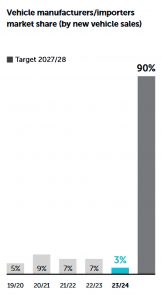

Vehicle manufacturers have not committed to the scheme as they ought to. Every vehicle imported will have a minimum of four tyres, or two in the case of motorcycles, yet only three per cent participated in the scheme in 2024, an actual drop from seven per cent in the previous year.

Tyre retailer participation also saw a drop from 2023, with only 44 per cent participating in the scheme. However, recyclers stand at around 85 per cent participation.

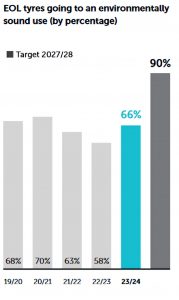

Interestingly, exports, despite the ban, increased to around 17 per cent of arisings, at 33,500t (shredded tyres). However, the TSA reports that the volume of tyres going to environmentally sound use has recovered after a slight drop in previous years, but still only represents 66 per cent of arisings.

If we come back to the UK comparison, there is no comparable data. The Tyre Recovery Association claims a very high percentage of tyres arising being recovered, but there is no definitive data on exactly where those tyres go. Although Peter Taylor, of the TRA advises that research has been initiated to establish the data in the coming year. And, of course, it is acknowledged by all in the UK that large volumes of UK tyre arisings go to export, often to unknown final destinations.

Perhaps the UK needs to take a leaf out of Australia’s book on tyre recycling. No system is perfect, but the UK needs to look at its options before its tyre recycling sector dies at the hands of exports to India, and a potential flood of cheap tyres from the Far East as a result of the UK not being a party to EUDR regulations.