In April, just shortly after the EuRIC Conference, the European Commission approved the ECHA RAC proposals to ban crumb rubber infill in its microplastics recommendations. The proposal is now out for consultation with the EU states and the outcome is expected to be in favour of the ban.

Speaking with Federico Dossena from Italy’s Ecopneus, the discussion got straight to the heart of the matter. Dossena explained, “Our understanding is that there is a quite wide consensus among the state members to go along with the change of the European regulations.

“Therefore, the 90 days and the two voting rounds will be absolutely in favour of the current proposal.”

This, in the medium term will surely have an impact upon the recycling industry. The tonnage not going to infill will have no market and that will create huge issues for the recycling sector and those managing tyre arisings.

Dossena adds, “The restriction will impact severely on the Italian supply chain for ELT. The Italian market for secondary raw materials from ELT is mostly based on infill for synthetic turf. Out of the overall mass, the main market is represented by sports surfaces.

“The Italian value chain will be quite severely impacted. At this point, we do not have the volume-consuming solutions capable of absorbing the quantities that will still be generated. We have to start watching the possible alternatives to handle the large volumes that will arise.”

By all accounts, the two potentially large consumers of ELT material are rubberised asphalt and the pyrolysis process. Italy has had several years of experience with test roads where studies have been carried out on rubberised asphalt, but there has been no widespread development of that market.

On the pyrolysis front, Italy has no operational tyre pyrolysis plants, and in the past, there has been considerable stakeholder disquiet about the idea of tyre pyrolysis.

Market Expected to Open for Rubberised Asphalt

“The vast majority of rubberised asphalt has indeed been the result of studies, many of which were promoted by Ecopneus. We can now say that the experience and the competencies are there, and the only missing element is the stimulus required to adapt rubberised asphalt. There is potential use, particularly in urban areas where noise limits have been set by law, and rubberised asphalt has the potential to reduce road noise to within those limits.

Therefore, our effort is addressing the administrators and authorities to act more firmly to support the adoption of rubberised asphalt. Our activity is now to start an immediate dialogue to promote and gain legal support to motivate local authorities to choose these solutions.”

Italy already has a green procurement policy for retreaded tyres and that has supported retreading in the country. So, now Ecopneus is driving for a similar procurement approach to rubberised asphalt.

In the wider European market, there is talk from the pyrolysis sector that this microplastics ban will help provide an impetus and create a pre-prepared feedstock supply for their own processes. However, there are currently no tyre pyrolysis projects operating in Italy.

Dossena responds; “Pyrolysis opportunities today have never taken place in Italy., because they were mistakenly evaluated as the equivalent of burning. However, now, the plastic sector has started to make some headway with a pilot plant that has been evaluated positively. Of course, we can utilise those results and this is a second line of engagement. We have started positive discussions with local authorities with a view to installing quite significant plants. They could take large volumes of pre-prepared tyres. This will also have an effect on the collection of tyres through the selection and segregation systems that will be required.

“We are starting to see segregation, car or truck, or even by brands. That will give the pyrolysis plants a given and controlled feedstock capable of giving a controlled output according to the specification the customer might require.

Changes Coming In Collection Processes

“That will make a change to the way tyres are collected and granulated compared to the experience of the past 10 years.”

On that point, we understand that the tyre manufacturers are becoming more interested and more involved in recycling. We heard recently that Aliapur had taken on three of Regom’s AI driven tyre selection systems and that Michelin has also taken on board a Regom system. That came not just from Regom, but also from Michelin.

We are also aware that SDAB, in Sweden, is looking at AI tyre selection, and that, of course has to be driven by the needs of the end client, the tyre manufacturer.

“The interaction that we have had from players from abroad coming to Italy to set up plants. There will be a need to go into segregation by brands, because every producer knows their own product and they would be interested in getting back their own material. So, we may see the pyrolysis plants working, one week for manufacturer A, the following week, working for manufacturer B. This might be a potential development that we can start identifying with those watching the Italian market for their next pyrolysis plant.”

It has been said by some in the industry that as soon as this legislation goes through, there will be no more demand for crumb rubber infill. No local authority, no sports club, is going to invest in a crumb rubber pitch that has just a short lifespan. In the interim, before the new markets develop, what happens to the material? Will Italy join the UK in shipping its waste to India?

Crumb Rubber Infill May Get Revisited in Time

“I have a different view,” says Dossena.” There are still a few fields in the process of being built. It is also true that there may be some doubts, but the local authorities have to confront themselves with the costs. Synthetic turf is still cheaper than natural grass. So, we might have a period that will meet the needs in the Interim. I am quite optimistic that companies will have the opportunity to keep running through the progressive decline of the crumb rubber infill sector, but also the lifting of demand for powder going into roads, and the even sooner than expected development of a pyrolysis plant.

“I am convinced that the overall acceptance of new technologies, with new jobs, professional technicians, and all these together will push for the development of pyrolysis plants sooner than expected.

“When talking to the Ministers, they understand the opportunities and they know that these developments cannot be left in the hands of other countries. The focus and attention of many stakeholders is now converging, and we will hopefully soon become a reality. The doubts and resistances are over. It is now a question of implementing an industrial process.

“Ecopneus is aware that we need large feedstocks and this may mean that we have to recover from the exports we have going to energy recovery.

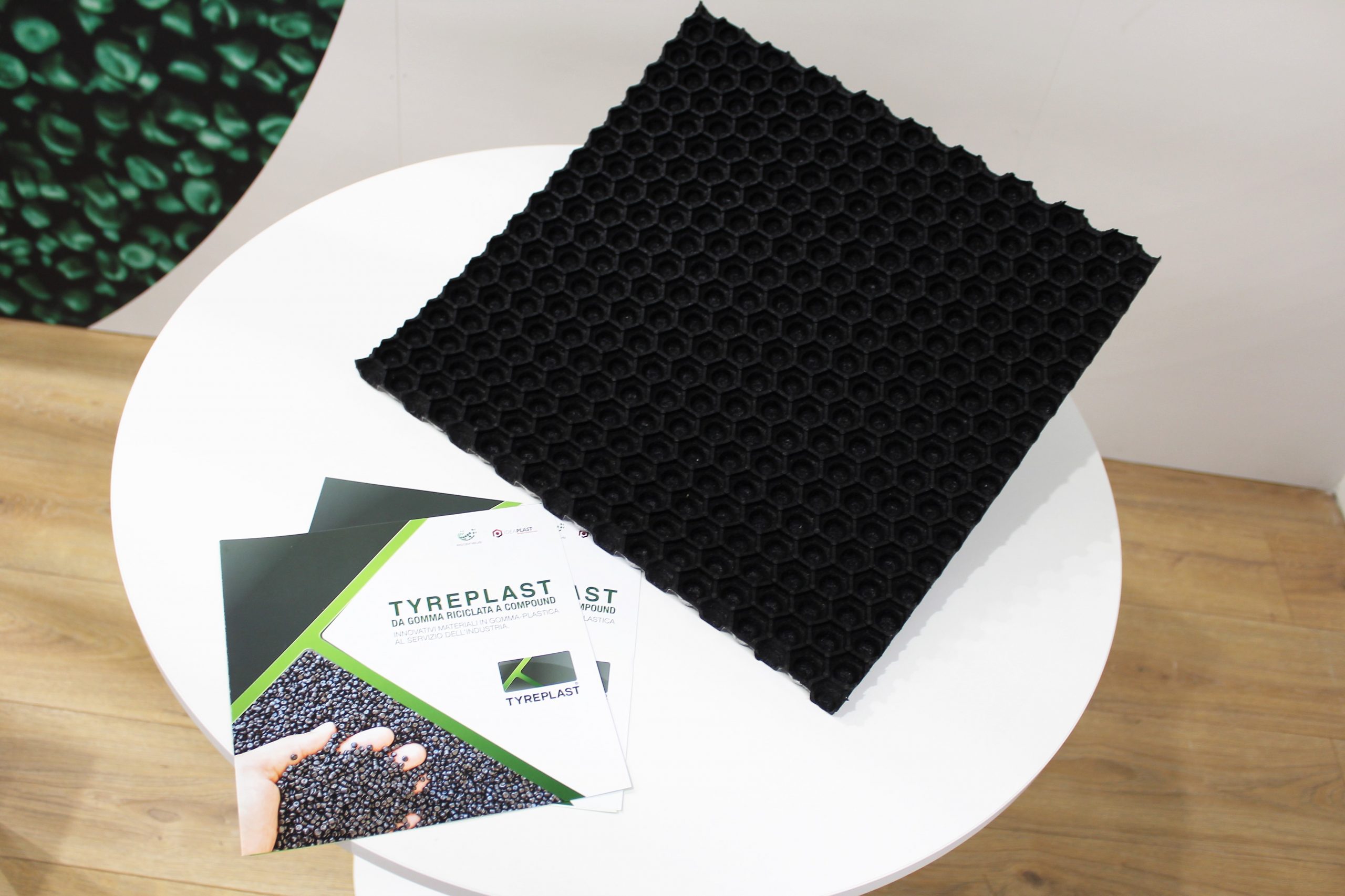

“We also have to consider the development of other markets, such as Tyreplas, where we mix tyres and plastics to create new products and markets for recycled rubber.”

We must not forget that after a period of studies and analysis to measure the real dispersion from fields, duly equipped with anti-dispersion measures, we may be able to go back to the European Commission with empirical evidence. The current decision has been made on assumptions rather than facts. We have a time-lapse and can accumulate a number of studies and we may be able to go back for a reconsideration on crumb rubber infill.”